The financial press and client conversations this quarter have been focused on Federal Reserve rate hikes, inflation and higher interest rates, and it is worthwhile for investors to try to better understand what the market is telling us on each front.

We believe that this story is best told with charts and some commentary below.

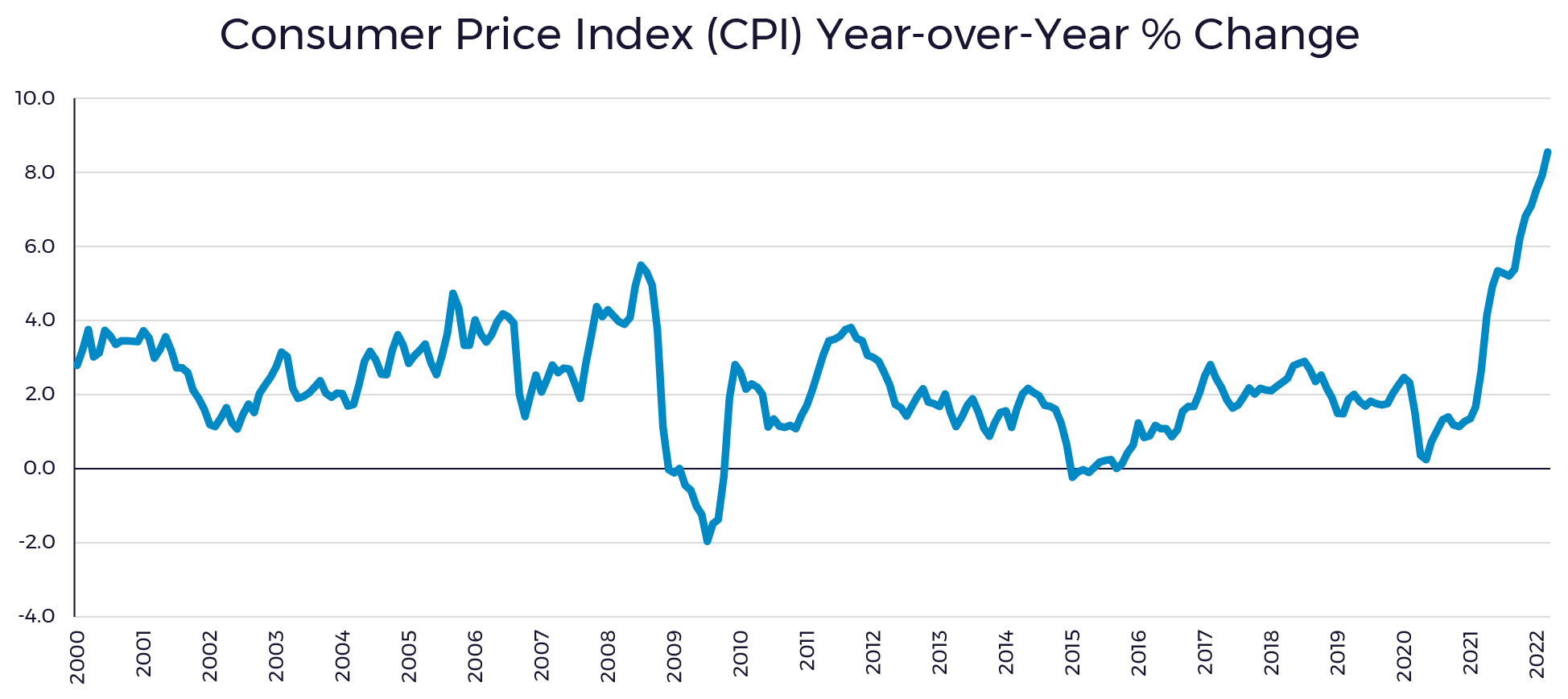

What has happened with inflation?

U.S. Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, Percent Change from Year Ago, Monthly, Seasonally Adjusted.” Retrieved from FRED, Federal Reserve Bank of St. Louis.

The year-over-year change in the Consumer Price Index (CPI), an economic measure of inflation, has significantly accelerated with the most recent data point being 8.5% in March. The market is expecting this to reach its peak in the next few months (June/July timeframe) with 9% data points expected.

For calendar year 2022, the expectation for CPI is somewhere between 6%–8% after being 5.9% in 2021.

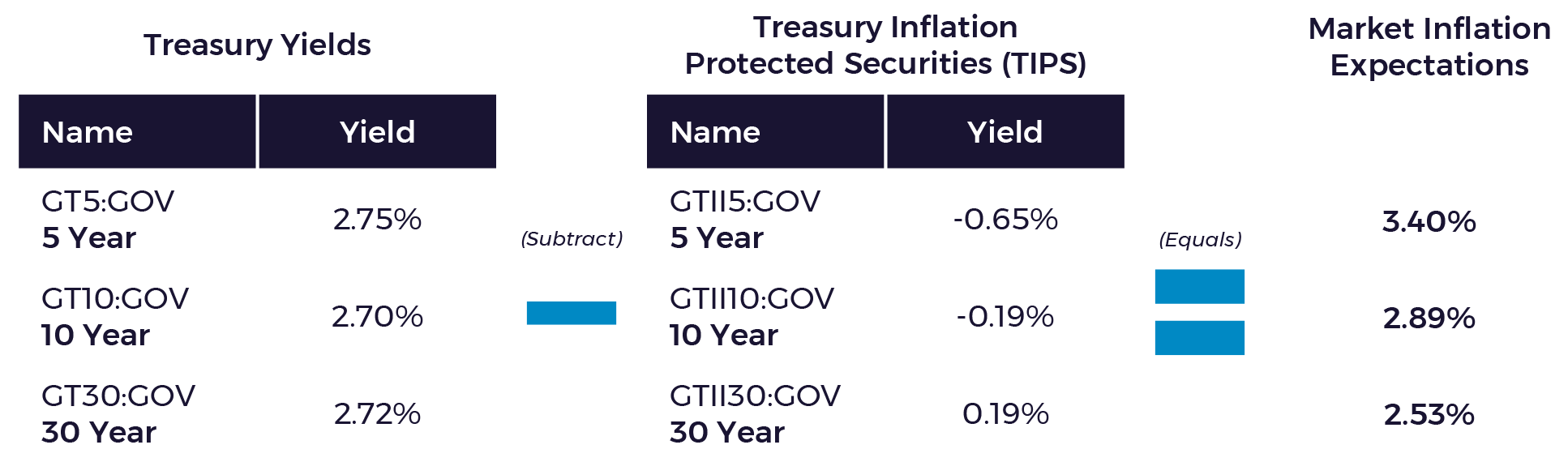

What do future expectations for inflation look like?

“United States Rates & Bonds.” Bloomberg.com. Accessed April 8, 2022.

The market’s inflation expectations are relatively benign. Expectations for inflation in 2023 drop to about 4%. Over the next 5 years, the market expects inflation to average 3.40%, 10-year expectations are an average of 2.89% and 30-year expectations are an average of 2.53%.

Laid out by years the expectations are:

2022–2026: 3.40%

2027–2031: 2.89%

2032–2051: 2.53%

Effectively, markets believe that the inflation we are seeing now will be relatively short-lived and longer term, we will be in a more normal inflation environment. Market expectations are based on the trillions of dollars that are invested by intelligent investors every day, and so are arguably the best expectation available.

But at least for 2022 and potentially in 2023, individuals receiving Social Security should see sizable increases in their annual cost-of-living adjustments.

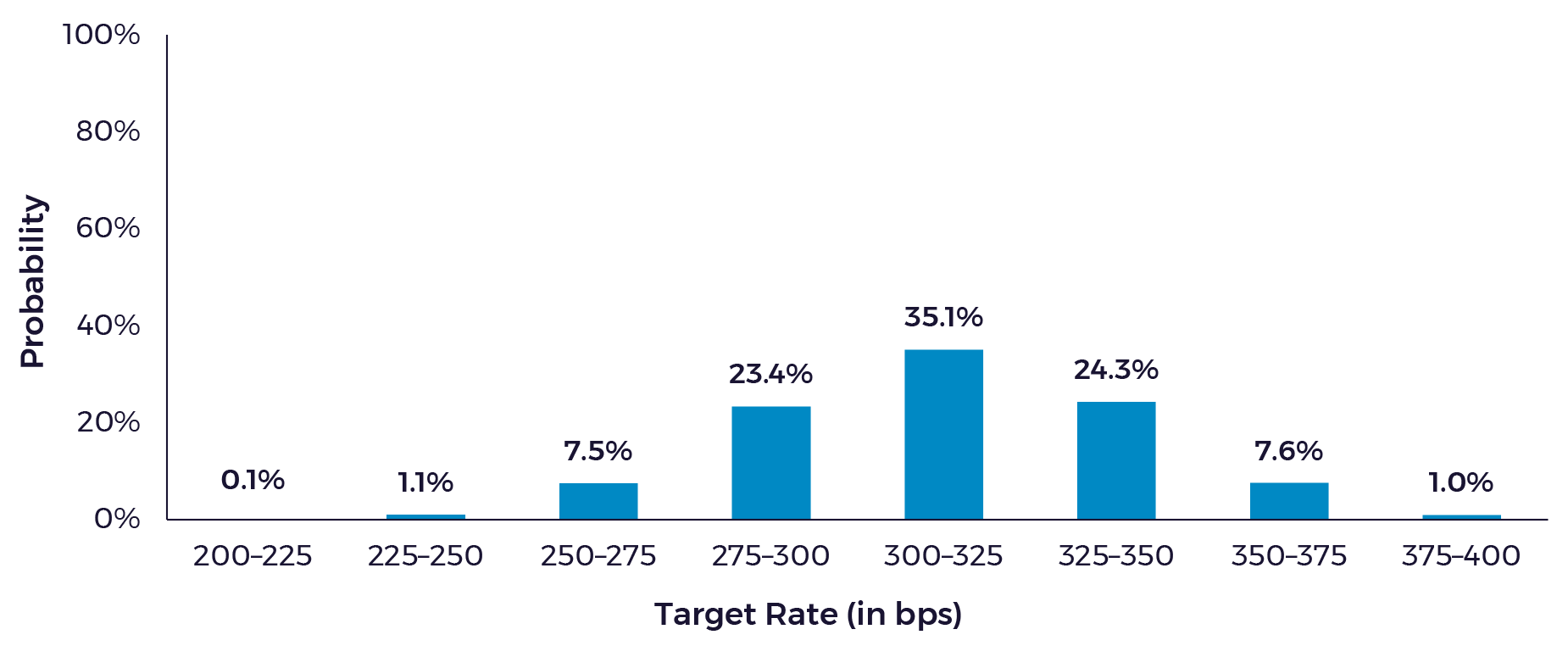

What are market expectations for Fed rate hikes?

“CME FedWatch.” cmegroup.com. Accessed April 8, 2022.

Currently, the expectation is for about 11 rate hikes of 25 basis point (0.25%) over the next 12 months (the Fed may do some 50 basis point hikes and, as an example, the market expects this in May). This would leave Fed rates between 3.00%–3.25%. The market expects the Fed to stop after that point.

The Fed is not likely to stop increasing rates until inflation shows signs of moderating and/or unemployment starts increasing. The rapidity of these hikes indicates that the market expects the inflation moderation and/or unemployment increases to occur within about 12 months from now.

What is the impact of higher rates on my portfolio?

As yields move higher, bond prices move down, which means bonds in most portfolios should have negative returns year-to-date. However, there is a big silver lining. For example, 7-year yields (average maturity of core bonds in our portfolios) are up about 1.24% since the end of 2021. This equates to a drop of value of about 7.8% for a 7-year Treasury bond. However, the expected return on the bonds has increased by 1.24% for each year because of the higher yield for the next 7 years for a total of 8.68% in additional expected return. Overall, the investor is better off long term by about 0.88%.

So as a bondholder, short term the price of the bond has gone down, however in the long term, the bondholder is wealthier because yields increased (since the coupons are getting reinvested at a higher rate than they originally would have been). For long-term investors, higher yields are unequivocally good for growth of wealth and for reducing the risk of running out of money, not only for bonds but also for stocks. This is because higher bond rates imply similarly higher equity expected returns (since equity risk premiums are generally accepted to be computed as a premium over a risk-free bond rate).

How are client portfolios taking advantage of the change in yields?

This Reuters article about the Dimensional bond funds is very timely. The summary is that, based on the changes in the curve, there are very high expected returns in the 2–3 year part of the curve and credit spreads (what you get paid for taking credit risk) are higher as well. So, within the funds that clients own, the allocation is moving slightly shorter on the curve and more toward lower-rated credits (higher expected returns). These changes affect the DFA Global Core Plus Fixed Income Portfolio (DGCFX) and DFA Global Core Plus Real Return Portfolio (DFAAX) primarily.

In addition, there has been a unique situation we have seen where long-term municipal bond yields have been the same or higher than Treasury yields for 30 years to maturity, even though municipal bonds are tax-exempt federally and Treasuries are not. This happens rarely in the market and makes municipal bonds very attractive on a relative basis (VWALX in our portfolios).

I am looking for a house. Should I be worried about mortgage rates increasing with Fed rate hikes? Do I need to lock in something now?

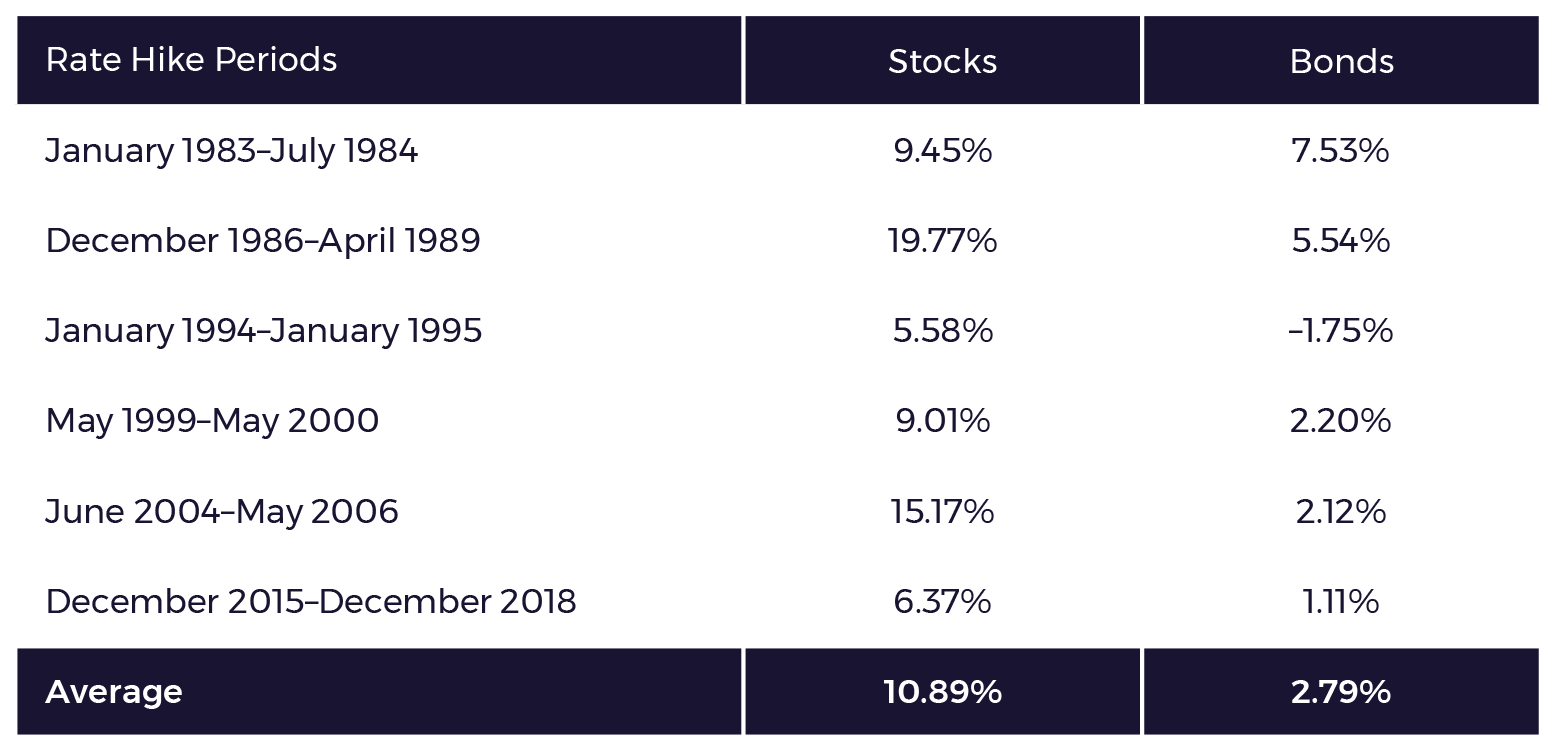

No, because markets are efficient and anticipate Fed rate hikes. As we said above, the market is already anticipating about 11 rate hikes of 25 basis points over the next year. That is already baked into long-term bond prices. This is the reason that over the last 6 rate hike cycles, bonds have made money in 5.

Stocks as proxied by MSCI World Index (gross div.). Bonds proxied by Bloomberg U.S. Government Bond Index Intermediate.

If rate hikes are greater or faster than the market anticipates, long-term yields should move higher and then mortgage rates will be higher. If they are slower or less, long-term yields should move lower and mortgage rates will be lower. But if Fed hikes are as anticipated by the market, then long-term yields need not change from their current level.

If you have any questions about how inflation and interest rates play a role in your financial plan, you can reach out to your advisor to re-evaluate and discuss.