Everyone has their own definition of what it means to take a risk. Some people find skydiving relaxing while the more cautious among us stop at a yellow light while driving instead of seeing it as an invitation to accelerate. The way we feel about risk in life sometimes extends to how we feel about market risk, which is why knowing and accepting your risk tolerance is essential to achieving your financial goals. That said, how we arrive at our ideal risk profile usually benefits from a little perspective.

Defining Your Ideal Risk Profile

Your true risk tolerance is defined by a combination of the willingness and capacity to take risk. You may be willing to take a higher level of risk but your capacity to do so — dictated by time horizon, ability to save, and the margin between what your portfolio can provide in retirement and what you actually need — will play a role in shaping your overall risk profile.

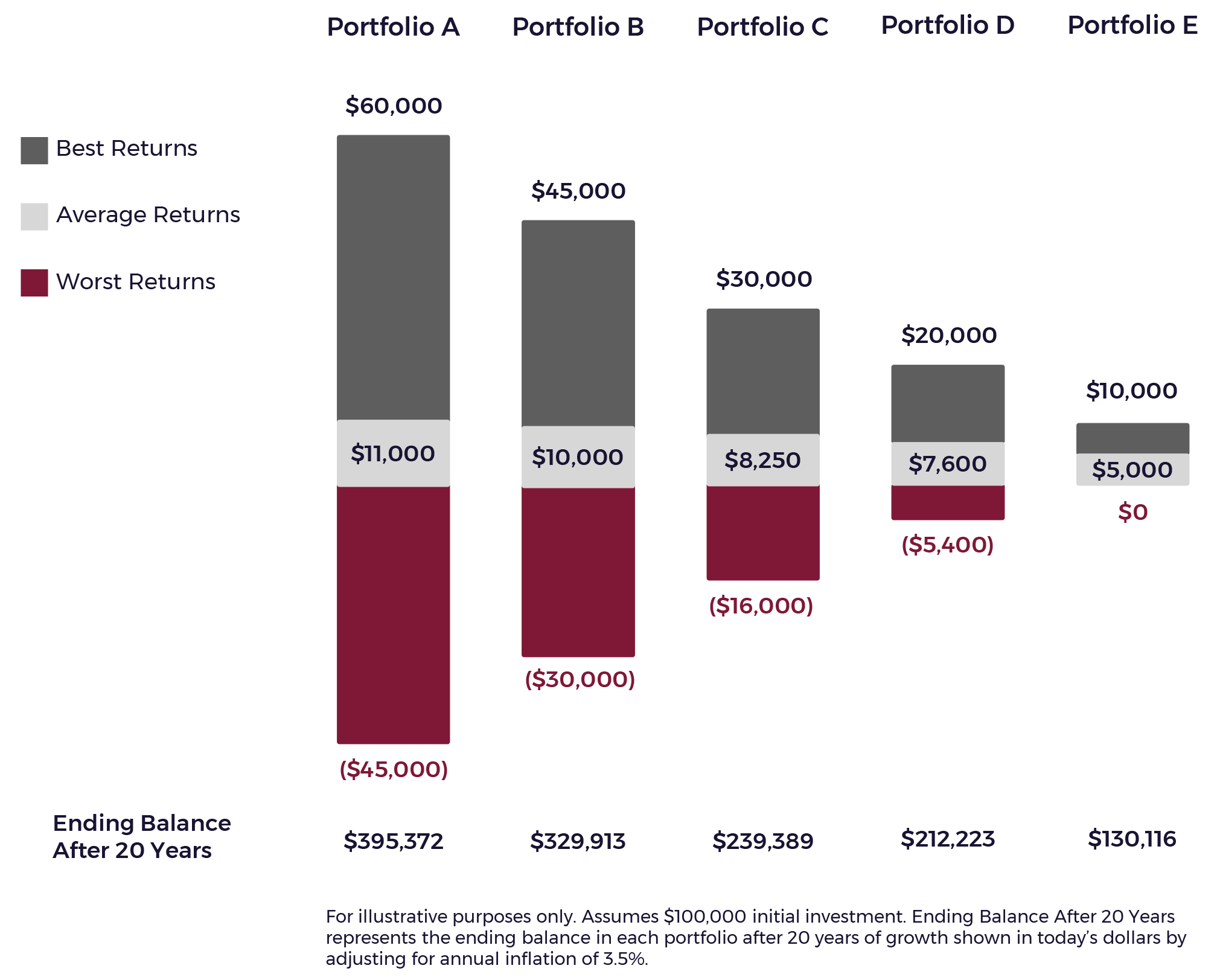

Turning to your willingness to take risk, the five scenarios in the chart below illustrate what risk looks like but not what it feels like if a portfolio were to experience a sharp market decline in a single year. Any investor who has completed a risk tolerance questionnaire will find this chart somewhat familiar.

Each portfolio shows three different possible returns (best, average and worst) for one year and an ending balance 20 years later after an initial investment of $100,000. The real goal of this exhibit is to uncover whether you could sleep at night if you were to incur a $45,000 loss as shown in Portfolio A in one year, or if one of the other portfolios would be more likely to keep you from counting sheep.

Even after you have determined how much of a market decline you can comfortably tolerate in theory, actual experiences and your reactions to them tend to be more telling. Market downturns challenge us to avoid taking hasty action when it seems that everything is telling us to do something. As an example, for many individuals it was difficult to stay disciplined during the market downturn in March 2020. With the benefit of some distance from the event, now is a good time to re-examine your feelings during that period. Were you looking to put your portfolio in the safety of cash, committed to staying the course or itching to take advantage of lower prices by investing more?

U.S. stocks (as proxied by the S&P 500 Index) dropped to a market low on March 23, 2020, with concerns about the effect of the pandemic on the global economy. Small cap and small cap value stocks (as proxied by Russell 2000 Index and Russell 2000 Value Index) also hit lows in March 2020 down 41.2% and 44.9% respectively.

Around this time, many investors found themselves unsettled in the face of uncertainty and market turmoil. Clients who had the resolve to remain invested at that time were amply rewarded for their patience.

The Power of Rebalancing and How Quickly the Market Can Move

A significant benefit of staying the course through difficult markets is how rebalancing enhances a portfolio even in down periods. Disciplined investors embrace the opportunity to buy stocks at lower prices even when it feels uncomfortable.

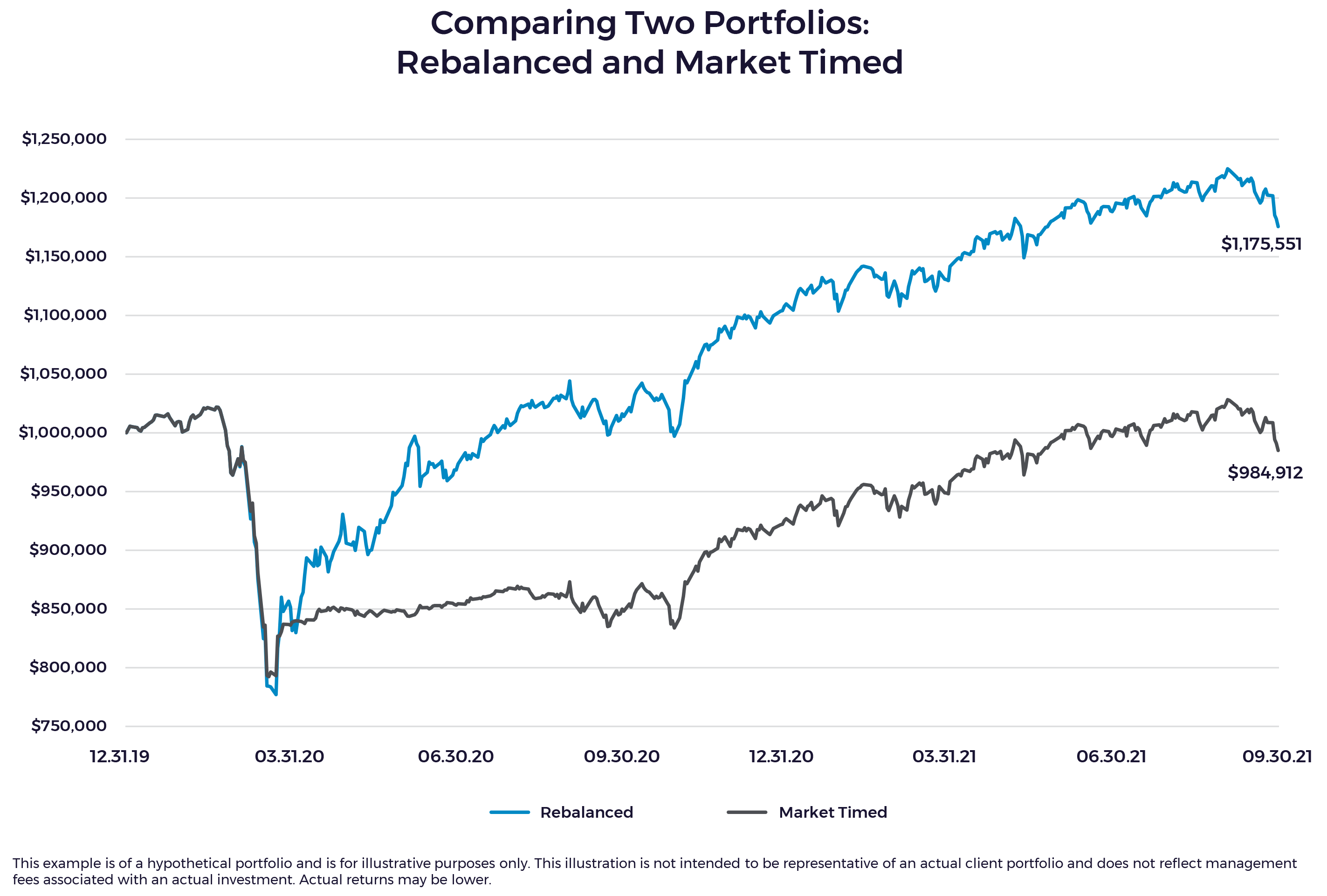

Forum portfolios have allocation guardrails in place that stipulate when rebalancing will occur. When the guardrails are crossed, this prompts trades that rebalance a portfolio back to its stated allocation with a careful focus on taxes and capital gains. In the graph below, we illustrate the round trip from the beginning of 2020 to the end of the third quarter 2021 for two portfolios (as proxied by the Forum GNP Core 60): a portfolio that was rebalanced when guardrails were crossed to return to the stated risk tolerance of a 60/40 allocation and a portfolio that demonstrates an attempt to time the market.

The purple line represents the portfolio of an investor who sold all stocks from the portfolio due to fear in late March 2020 when U.S. stock prices plummeted at the start of the pandemic. The investor sat on the sidelines through the summer and bought back stocks in late August 2020 when U.S. stock prices returned to their beginning-of-the-year levels. By doing this, this investor got back into the market at higher equity levels and with less capital than was originally allocated, basically locking in a $184,000 loss. In a failed attempt to time the market, this investor had a portfolio value 19.4% lower than the rebalanced portfolio.

The rebalanced portfolio, represented by the green line, systematically took advantage of the stock market selloff and bought more stocks in March 2020 on two occasions by reducing bonds when the allocation exceeded 44% (versus the 40% target of the 60/40 allocation) and buying more stocks to bring the allocation back up to 60%. Conversely, on three occasions during this period, the allocation to stocks exceeded 64% and the portfolio was rebalanced back to its original 60/40 target allocation. The rebalanced portfolio exceeded the value of the market-timed portfolio by almost 20%.

Forum clients continue to reap the substantial rewards of this approach, which is why we advocate rebalancing to stay disciplined to your risk tolerance. While the chart above provides a snapshot of the power of rebalancing, it also offers a glimpse of how quickly things can change and the folly of trying to change during volatile periods.For those who considered drastically altering their asset allocation or exiting the market completely in the early months of 2020, we suggest two action steps to take today: speak with your advisor and conduct a financial lifeboat drill.

The Investor, the Stock Market and the Lifeboat Drill

If you have the choice of completing a lifeboat drill while docked in the harbor on a sunny day or while on the water in the middle of a thunderstorm, the obvious choice would be to run your tests with your feet firmly planted by the water’s edge.

Logic tells us to take advantage of the calm before the storm — defined in this scenario as a time with relatively low market volatility. During this exercise, it is useful to keep an open mind about what you may discover.

There are dozens of cognitive biases that can hamper an investor’s decision-making process. Recency bias can lead someone to believe that what happened yesterday with stock prices will persist indefinitely. They say hindsight is 20/20, which is the foundation of hindsight bias where people recall that they guessed the correct result of an unpredictable event when they did not.

For our financial lifeboat drill, we suggest that you review your risk tolerance to give you new perspective on your ideal risk profile. Your advisor can assist with this exercise. This process focuses on current needs along with your acceptance of market movements that would generally be deemed worst-probability outcomes.

Part 1: Evaluate What You Need – Your Capacity to Take Risk

- Assess your capacity to take risk. You may realize that you have a large margin of safety and can achieve your financial goals with lower risk. On the other hand, an allocation that is too conservative could cause your planned distributions to exceed what is sustainable for the overall portfolio.

Part 2: Examine How You Feel When the Stock Market Slumps – Your Willingness to Take Risk

- Revisit your current risk tolerance. You had a sense of how much market decline you thought was tolerable when your portfolio was originally built, which defined your risk tolerance.

- Explore the downside. Your willingness to take risk should not be based on your feelings when the market does well. If you experienced a steep or prolonged market decline, if you felt the need to change to a more conservative allocation, we regard this as a signal that you may have taken on more than you can handle when it comes to market volatility.

Part 3: Determine Next Steps

- Consider potential allocation changes. The best time to make a change to your asset allocation to a more conservative allocation is following a market recovery. We suggest looking at your cash flow needs to evaluate if the allocation to stocks can be reduced toward a lower-volatility portfolio while still meeting your cash flow goals.

- Make any necessary adjustments. Your advisor will help you to balance competing needs in a way that does not negatively impact your long-term financial goals and any current cash flow needs.

We recognize that risk and expected return are related. We want to help you maximize your after-tax wealth for the right amount of risk for you. If you want to discuss your willingness and capacity to take risk and how that relates to your current portfolio, please contact your financial advisor.

By clicking on a third-party link, you will leave the Forum website. Forum is linking to this third-party site to share information in a different format and is for informational purposes only. However, Forum cannot attest to the accuracy of information provided by this site or any other linked site. Forum does not endorse the site sponsors or the information or products presented there. Privacy and security policies may differ from those practiced by Forum.