As we make our way into the new year, the end of 2021 feels similar to the end of 2020, as the emergence of the Omicron variant extends the pandemic. To add to this all-too-familiar uncertainty, investors have expressed similar feelings toward financial markets with the S&P 500 Index reaching record highs, seemingly in defiance of the pandemic and unexpectedly high inflation.

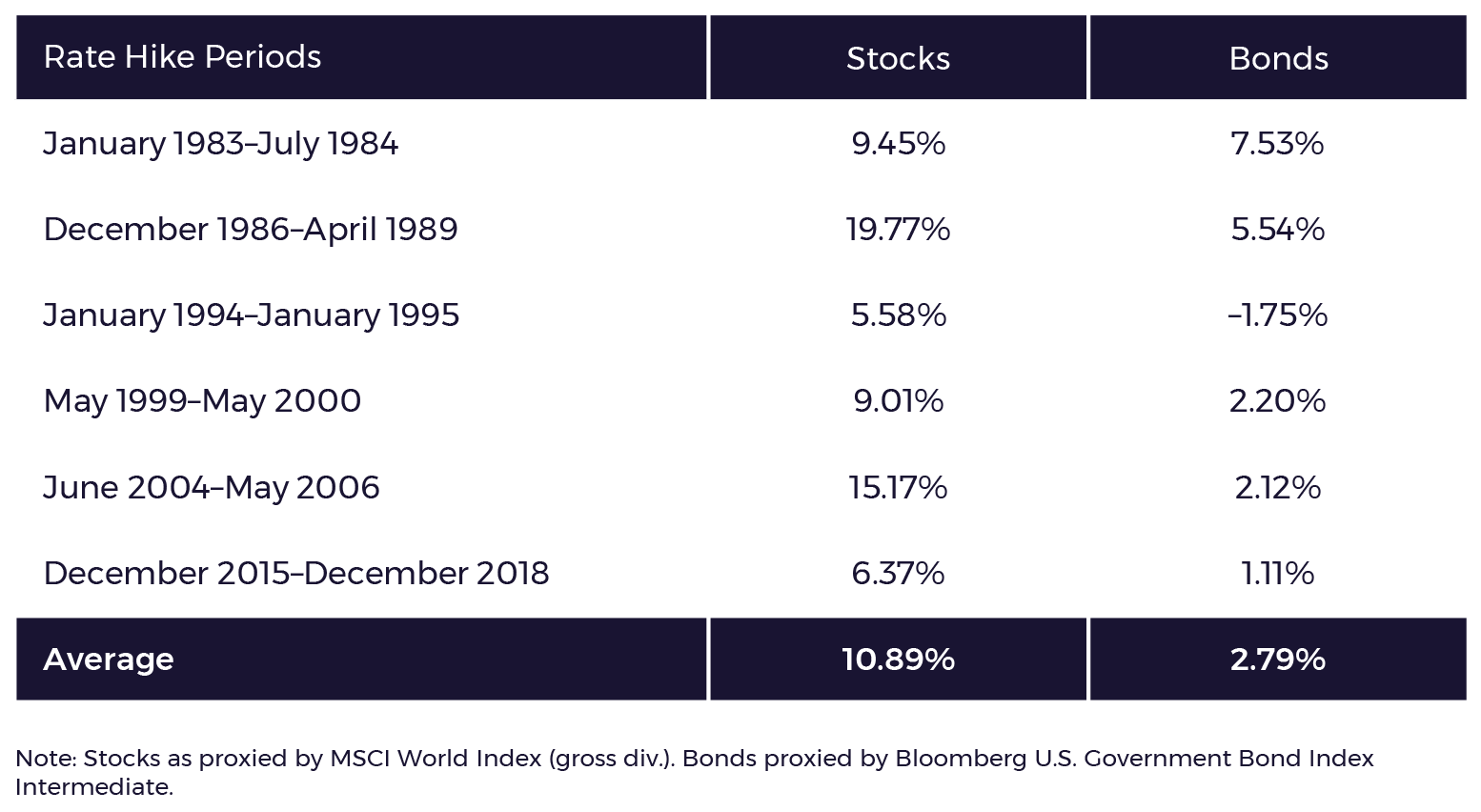

Questions on when the Federal Reserve will begin starting to raise interest rates have investors questioning performance of stocks and bonds, often fueled by headlines suggesting that rising rates are bad for stocks and bonds. In contrast, the historical data shows that five of the last six rate-hike cycles, long-term bonds have had positive returns. We know that markets are reasonably efficient and have already priced in the expected rate hikes into the current prices of stocks and bonds. To provide further perspective, we have compiled a short list of market and economic topics top of mind that helped define the year as we make our way into 2022.

Topic 1: Equities reached record highs and we saw small capitalization and value positioned companies perform strong to end the year.

Investors saw indices climb to record highs throughout the economic recovery in 2021. The S&P 500 set 70 closing record highs throughout the year or ended trading at an all-time high for about 30% of trading days, the second highest number besides 1995.1 This is due to a handful of stocks that performed exceptionally well, appearing immune and/or benefiting from pandemic turmoil and setting new highs. Fortunately, our diversified portfolios systematically capture the performance of these “mega winner” stocks, rebalancing to lock in gains and mitigate risk as the stocks appreciate.

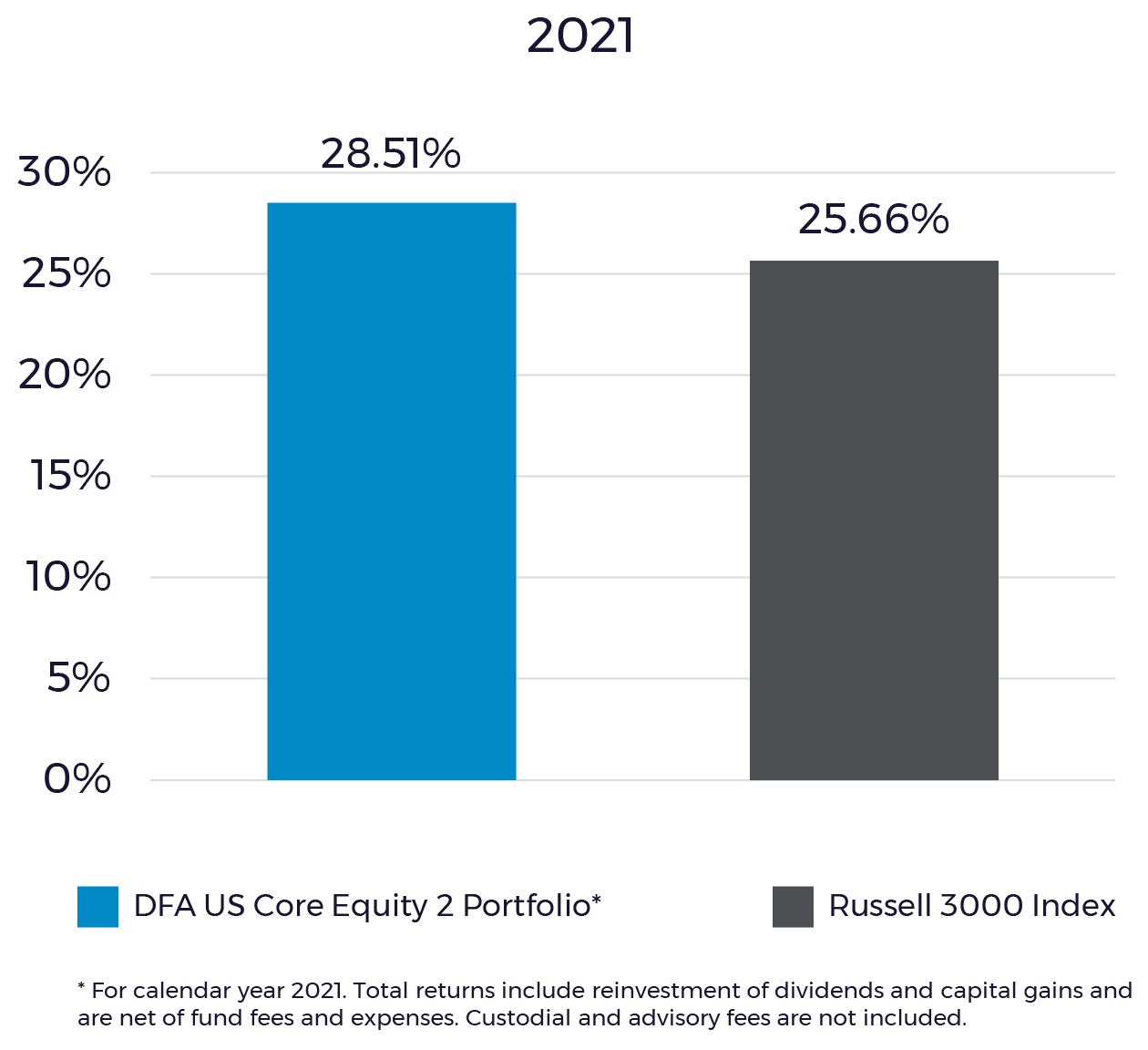

Since our portfolios are statistically tilted toward small capitalization and value positioned companies, we took a deeper look at the performance of one of our holdings on the year. Over the course of 2021, our DFA US Core Equity 2 Portfolio (DFQTX) holding outperformed the benchmark Russell 3000 Index by nearly ~3%. Notably, in the fourth quarter, the fund saw a return of 9.7% despite the headwinds from the global pandemic and supply chain disruption.

As humans, we are conditioned to think that a rise must be followed by a fall. In one sense this is true, part of investing is weathering the short-term market drops that occur with unsettling, yet still surprising, regularity. On the other hand, we do expect markets to increase theoretically forever in a compound fashion, so decades from now, today’s prices will be a thing of the distant past, never to be revisited. Between now and then, we do not know. Given that market prices today incorporate market participants’ current knowledge and expectations, we know stocks have a positive expected return. We do not know, just like we will never know, what the actual return will be before it happens.

Topic 2: Consumers are feeling the biggest sticker shock in the last few decades as inflation has risen.

Another high seen recently is the annual change in the Consumer Price Index, or the most widely used barometer for consumer inflation, reaching 6.8% in November 2021, which is a level not seen since the 1980s. The recent rise is the fastest on an annual basis since the 1980s and the first time many consumers and investors have experienced these levels. Investors may be worried that this recent rise may impact portfolio performance or returns in the future.

There are two parts wrapped into this notion we would like to point out when thinking about how inflation may impact your financial picture:

- History tells us it is difficult to time markets around inflation expectations.

Those who want to hedge against persisting higher inflation would require a correct prediction on when to trade the portfolio to hedge against and then when to trade the portfolio back. This essentially comes down to a market timing strategy. Most often, the response from investors looking to address this issue would trade in response to market headlines or economic data, which we know to be priced into the markets already, given they are relatively efficient

- In the long term, stocks are the best hedge for inflation.

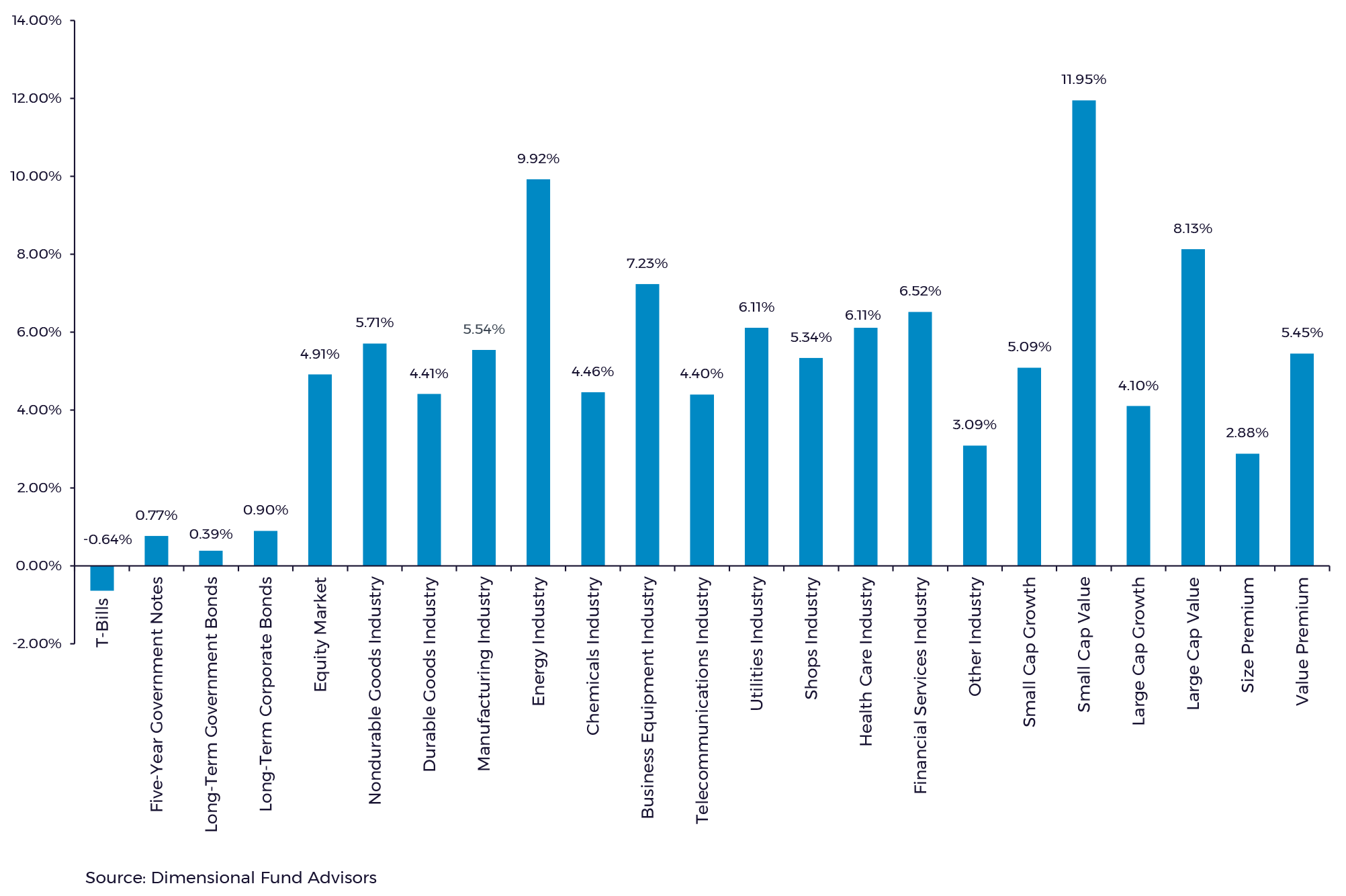

The below graph illustrates 23 U.S. asset classes and their real returns (returns net of inflation) in high inflationary periods (above-median inflation) from 1927 to 2020. Average inflation in this analysis is 5.5% per year and covers periods with double-digit U.S. inflation and deflation. The result is that all asset classes except for one-month Treasury bills had a positive average real return in high-inflationary periods. The data suggests that staying invested for the long term will help outpace inflation curbing thoughts on today’s rising prices making it harder to reach financial goals.

Topic 3: Investors are worried about the outlook for bonds given the implications of rising inflation and increasing interest rates.

The subsequent rise in inflation and the Federal Reserve’s intention to end its monthly bond-buying program by March 2022 have raised questions about when interest rates will begin to rise and the impact on the performance of bonds. The conventional wisdom is that since increasing yields mean lower bond prices, the Fed hiking rates will cause bonds to lose money. But this is not true, in fact it is not even a coin flip. Bonds have actually made money 5 out of the last 6 rate hike periods (versus what used to be 4 out of the last 5 periods). The table below illustrates this point:

There are two major factors driving this result:

- Bond markets, like stock markets, are mostly efficient, so therefore rate hikes should be priced in. Bonds only lose value if rate hikes are faster, larger or last longer than the market expects. If hikes are slower, smaller or fewer than the market expects then bonds should actually increase in value

- Fed hikes have a strong correlation with changes in yield on the short end. The long end has almost no correlation with the short end and therefore with rate hikes. The biggest factor for long-term yields and therefore returns is inflation expectations. Higher inflation expectations will drive higher long-term yields and therefore lower bond prices. However, higher yields mean higher income, and this is the reason that even in high-inflation environments, long-term bonds have positive returns net of inflation. Lower inflation expectations will drive lower yields and higher prices for bonds.

Topic 4: The labor market bounced back (demand is up), however, there are too few workers rather than too few jobs with changes in those willing to work or quitting (supply is down).

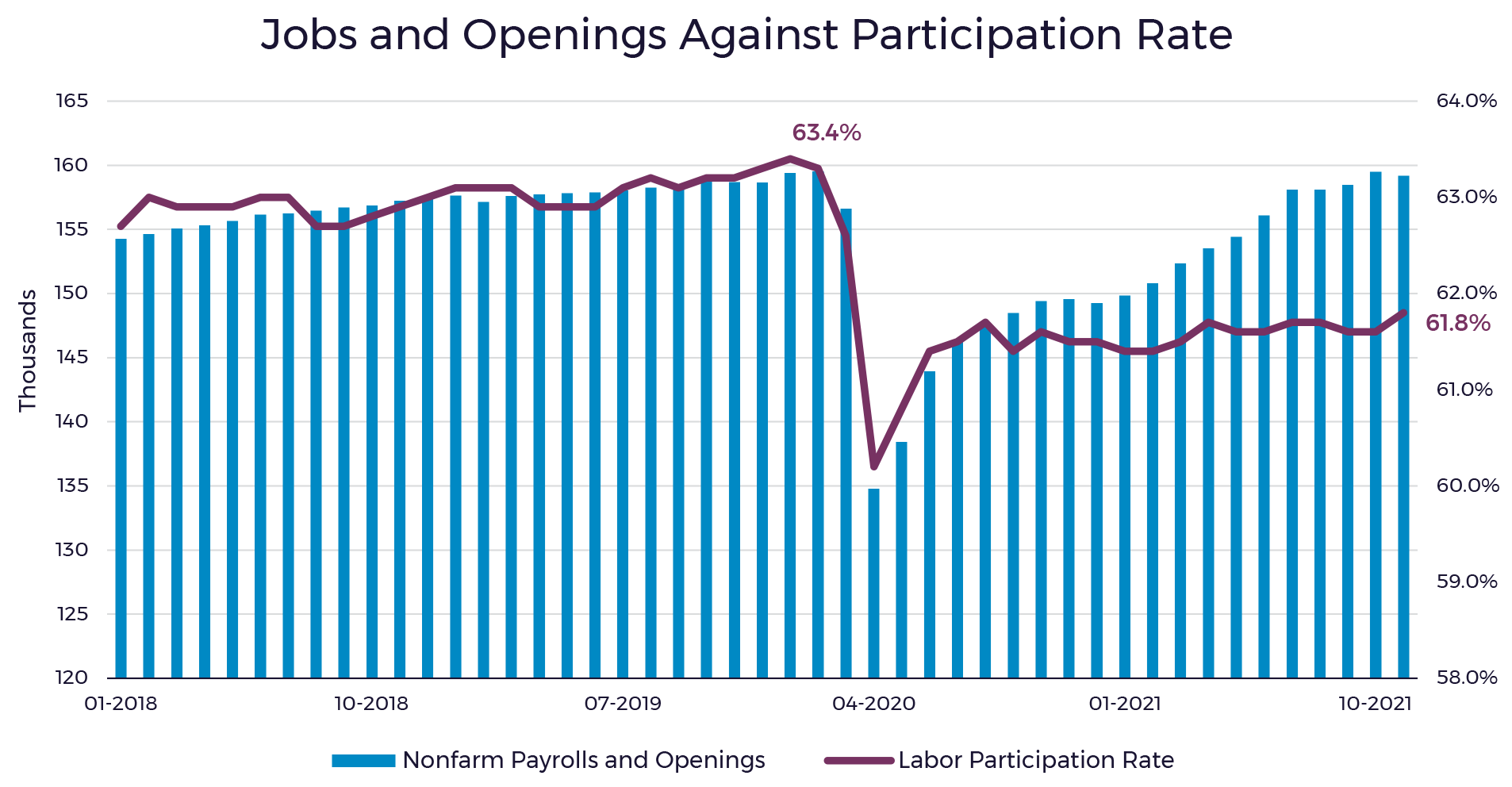

There are certainly two different sides to the coin when looking at the U.S. labor markets.2 2021 started what we have been calling the Great Resignation — people quitting jobs at historically high rates. The number of people leaving their jobs as a percentage of total employment hit a record high of 3.0% in September 2021 with 2.8% for October and a preliminary 3.0% for November. There continues to be labor shortages particularly in hard-hit pandemic sectors of the market such as restaurants and health care. The 2020 recession and onset of the global pandemic set off the quickest period to reaching an unemployment rate high of 14.8% with nearly 22.1 million jobs lost between January 2020 and April 2020.

However, on the flip side, the economy has recovered 18.5 million jobs lost since March 2020 and the unemployment rate has recovered to 4.2% as of November 2021, an unemployment rate at which the Congressional Budget Office did not expect until 2024. Total job openings remain high and have all but recovered since pre-pandemic levels and unemployment claims recently notched a 52-year low. This dynamic between supply and demand has empowered many to quit their jobs ahead of another lined up or demand higher wages.

We remind ourselves of the need to stay the course and remain disciplined throughout this continued uncertainty and that the market remains efficient and forward-looking. In recent remarks by David Booth (“Why I’ll Always Be Optimistic About the Market”), he shares this perspective: “Rather than having to guess what will happen to whom and when, I choose a different path. I invest in the market. … Markets will go up and down, but you should expect them to be positive, and that is what history has also shown.”3

SOURCES

1 Anna-Louise Jackson and John Schmidt, “2021 Stock Market Year in Review.” Forbes, January 3, 2022.

2 Retrieved From FRED, Federal Reserve Bank of St. Louis, via Bureau of Labor Statistics, U.S. Department of Labor. Accessed January 6, 2021.

3 David Booth, “Why I’ll Always Be Optimistic About the Market.” Dimensional Fund Advisors, December 21, 2021.

By clicking on a third-party link, you will leave the Forum website. Forum is linking to this third-party site to share information in a different format and is for informational purposes only. However, Forum cannot attest to the accuracy of information provided by this site or any other linked site. Forum does not endorse the site sponsors or the information or products presented there. Privacy and security policies may differ from those practiced by Forum.